VAT stands for “Value-Added Tax.” It’s a consumption tax that applies to goods and services at each stage of the production and distribution chain. Unlike sales tax, which is typically charged only at the final point of sale to the consumer, VAT is collected incrementally at each step where value is added. In practice, businesses charge VAT to their customers and then remit it to the tax authorities, but they can also reclaim the VAT they’ve paid on their own purchases. This system helps prevent double taxation and ensures a consistent application of tax throughout the supply chain.

For non-Japanese enterprises dealing with Japan, understanding VAT is crucial because it affects pricing, compliance, and overall business strategy.

Author: KAZUHISA MOCHIZUKI

Tax Audits in Japan

Tax Audit Frequency and Objectives

In Japan, tax audits are a routine part of the self-assessment system for both corporate tax and consumption tax. Approximately 100,000 corporate tax audits are conducted each year. Typically, profitable companies can expect an audit about once every five years. The primary purpose of these audits is to strengthen the self-assessment process and ensure fair taxation. The National Tax Agency (NTA) is responsible for reviewing tax returns, comparing them with the taxpayer’s financial records, and correcting any discrepancies.

Audit Process

The NTA focuses on auditing companies suspected of tax evasion, dedicating significant time to thorough investigations. The audit process generally follows these steps:

- Advance Notice of Tax Audit:

In most cases, taxpayers are notified of an upcoming audit via phone, allowing them time to prepare. However, if the NTA needs to verify certain business activities directly, advance notice may not be given. - Conducting the Audit:

Upon arrival at the taxpayer’s office or residence, tax auditors will present official identification. A successful audit relies on the taxpayer’s full cooperation, including providing transaction records and answering inquiries. While audits are typically conducted in the taxpayer’s presence, a Certified Public Tax Accountant (CPTA) can represent them if preferred. - Post-Audit Actions:

If discrepancies are found, the Tax Office will explain the errors and outline the additional tax liabilities, recommending that the taxpayer files an amended return. Failure to comply may result in the District Director issuing mandatory corrections. If no issues are identified, the Tax Office will confirm the accuracy of the return or provide advice for future submissions and record-keeping.

Statute of Limitations

The statute of limitations for corporate and consumption taxes in Japan is generally five years from the filing due date of the original return. For loss-making years, the period extends up to nine years for fiscal years ending on or before March 31, 2018, and ten years for those starting on or after April 1, 2018.

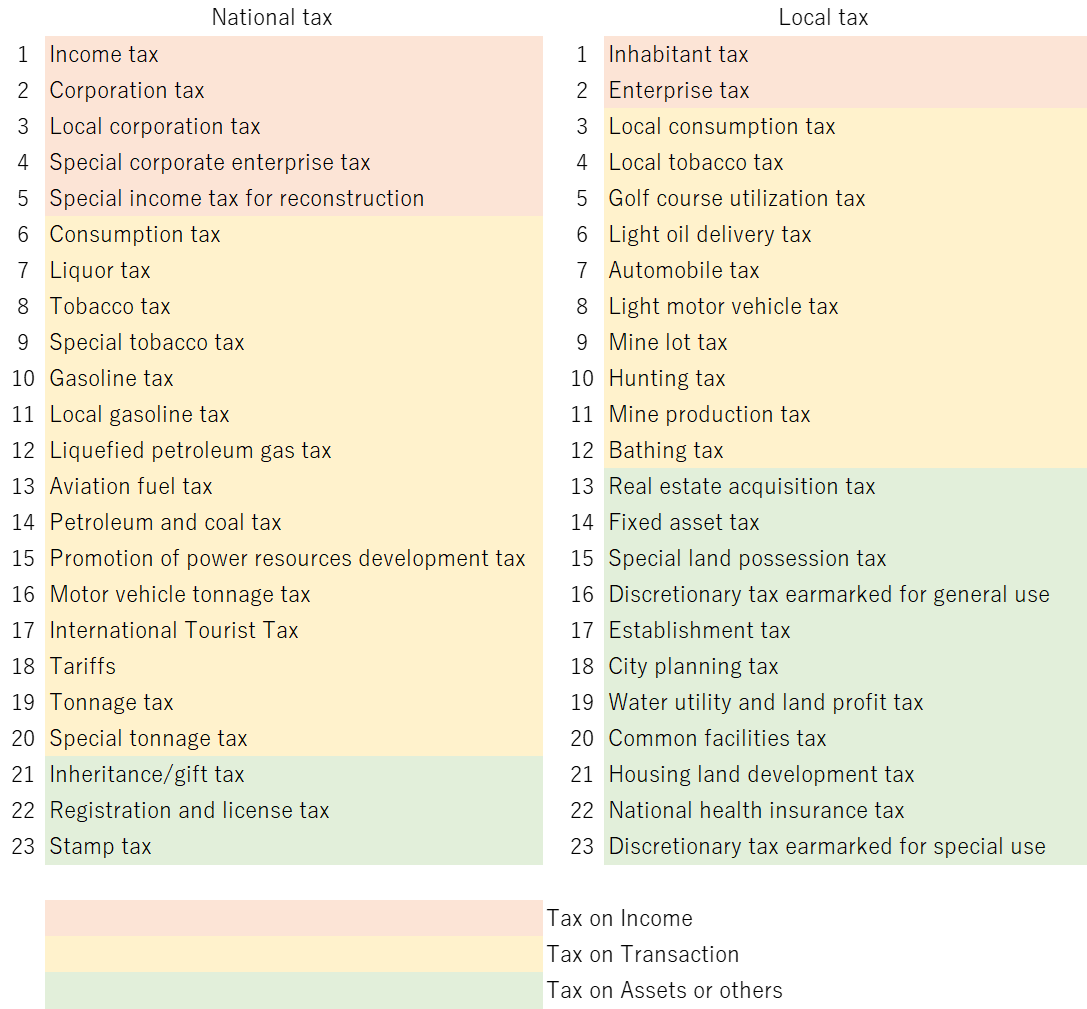

Japanese Tax Items

Japan’s tax system, while extensive with over 40 different tax items, primarily revolves around a few key areas for most taxpayers: the income taxes and the consumption tax. The system is evenly divided between national tax and local tax in terms of both the number of tax items and the overall revenue generated. Although there are various special-purpose taxes on specific goods such as liquor, tobacco, and automobiles, these tend to have less impact on the majority of individual taxpayers.

Crucially, Japan’s tax laws apply universally to all individuals, regardless of nationality. However, the tax implications for each taxpayer can vary significantly depending on the specific regulations governing each type of tax. Understanding these nuances is essential for effective tax planning and compliance, particularly for those subject to multiple tax jurisdictions or with complex financial arrangements.

In summary, while Japan’s tax structure may appear intricate at first glance, focusing on the core components, such as income and consumption taxes, simplifies the landscape for most taxpayers. A thorough understanding of the detailed regulations and how they apply to individual circumstances is critical for navigating the system effectively and ensuring compliance.

Japanese Tax Items

Deduction of social welfare contribution born by individuals for income tax purposes

The Japanese Income Tax Act defines deductible social welfare contributions, referred to as “social insurance premiums,” as follows:

- premiums for health insurance paid by the resident as an insured under the provisions of the Health Insurance Act (Act No. 70 of 1922);

- premiums for national health insurance under the National Health Insurance Act (Act No. 192 of 1958) or national health insurance tax under the provisions of the Local Tax Act;

- premiums under the provisions of the Act on Assurance of Medical Care for Elderly People (Act No. 80 of 1982);

- premiums for long-term care insurance under the provisions of the Long-term Care Insurance Act (Act No. 123 of 1997);

- labor insurance premiums paid by the resident as an insured of employment insurance under the provisions of the Act on the Collection, etc. of Insurance Premiums of Labor Insurance (Act No. 84 of 1969);

- premiums for national pension to be paid by the resident as an insured under the provisions of the National Pension Act and premiums to be paid by the resident as a member of the National Pension Fund;

- premiums for farmers pension paid by the resident as an insured under the provisions of the Act on the Farmers Pension Fund, Independent Administrative Agency;

- premiums for Employees’ pension insurance paid by the resident as an insured under the provisions of the Employees’ Pension Insurance Act;

- premiums for Mariners” insurance paid by the resident as an insured under the provisions of the Mariners’ Insurance Act;

- premiums under the provisions of the National Public Officers Mutual Aid Association Act;

- premiums (including special premiums) under the provisions of the Local Public Officers, etc. Mutual Aid Association Act;

- premiums paid by the resident as a member under the provisions of the Private School Personnel Mutual Aid Association Act; and

- payment under the provisions of Article 59 (Pension payment) of the Public Officers Pension Act (including the cases where applied mutatis mutandis pursuant to other laws).

Essentially, the above provisions clarify that only contributions to Japan’s public social welfare funds are considered deductible expenses for income tax purposes.

However, there are exceptions under tax treaties. For example, Article 18 of the Japan-France tax treaty, as modified by Article 12 of its Protocol, specifies that social insurance premiums paid to the social security system of one contracting country by individuals from the other contracting country who are working in the host country, as stipulated by the Japan-France Social Security Agreement, are mutually recognized as deductible in the country of employment.

Therefore, in very exceptional cases outlined in tax treaties and social security agreements, contributions to foreign social welfare systems may also qualify as deductible.

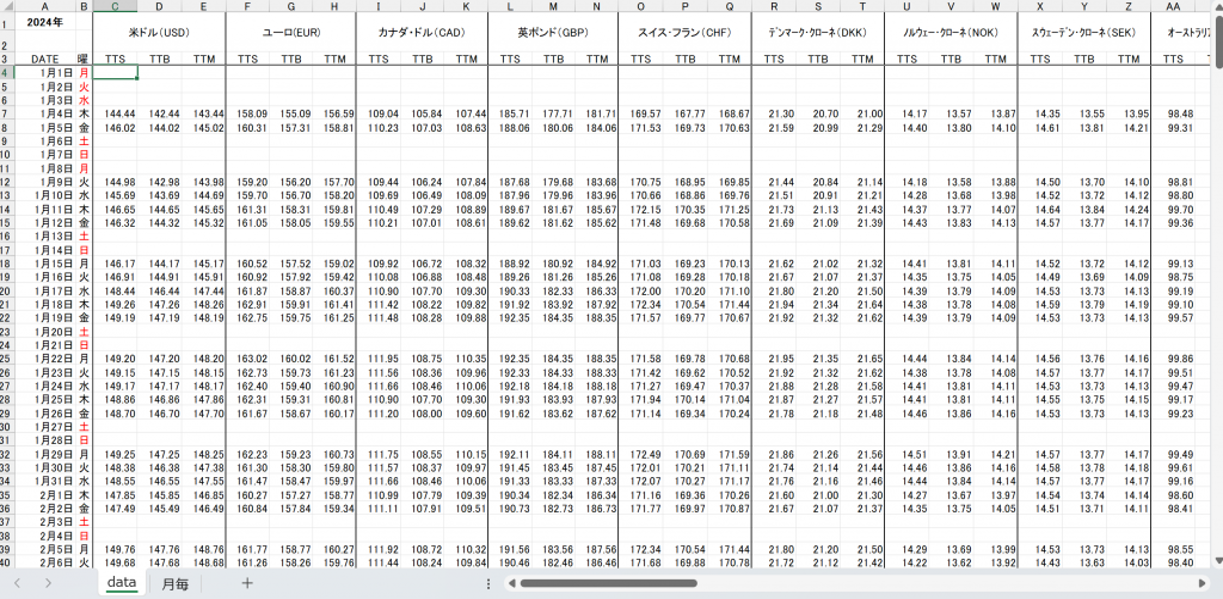

Japanese Foreign Exchange rates in handy reference

Useful Resources for Historical FX Rates

Tips: Each tax act may have unique regulations for determining the applicable foreign exchange rate. Generally, the Income Tax Act adopts the TTM (Telegraphic Transfer Middle rate) as of the transaction date.

The most comprehensive set of data available in excel format:

For a full set of FX rates available in Excel format, you can select the desired year and download it directly.

https://www.murc-kawasesouba.jp/fx/past_3month.php

The end of month FX rate at one sight:

https://www.supercostdown.info/kawasekinri3.html

Taxation on Expats leaving Japan

The Final Tax Declaration as Residents

Residents:

Those who have a domicile in Japan and have resided continuously in Japan for one year or more.

Non-residents:

All individuals other than residents.

When the individual has an occupation overseas that typically requires them to reside continuously for more than one year, they are presumed to be non-residents immediately after the departure from Japan.

| Practical application of presumption of domicile (basic circular) In order to make it more practical and uniformed judgments regarding the specific application of the provision for presuming the presence or absence of a domicile, unless the period of service outside of Japan for employees working outside of Japan is limited to less than one year in advance in contracts, it is presumed that the person does not have a domicile in Japan. |

Tax Declaration at the Time of Departure

Article 127. Where a resident is to make a departure from Japan during the year, and a return under the provisions of Article 120(1) (Income tax return) needs to be filed with regard to the amount of gross income, the amount of retirement income, and the amount of timber income of the resident for the period from January 1 of the year until the time of his/her departure, the resident must file a return stating the matters listed in the items of paragraph (1) of the said Article based on the circumstances as of the relevant time with the district director of the tax office by the time of the departure, ….

Definitions under Article 2, Paragraph 1 of the Income Tax Law

(xlii) departure: with regard to a resident, to cease to have a domicile or a residence in Japan without making a notification of tax administrator under the provisions of Article 117(2) (Tax administrators) of the Act on General Rules for National Taxes, and with regard to a nonresident, to cease to have a residence in Japan without making a notification of tax administrator under the said paragraph (with regard to a nonresident who does not have a residence but has a permanent establishment in Japan, this term means that such nonresident ceases to have a permanent establishment, and with regard to a nonresident who does not have a residence nor a permanent establishment in Japan, this term means that such nonresident discontinues the business prescribed in Article 161(1)(vi) (Domestic source income) that the nonresident conducts in Japan);

Cases Not Requiring Final Income Declaration According to Article 121 of the Income Tax Law

Article 121. Notwithstanding the provisions of paragraph (1) of the preceding Article, where a resident who has employment income for the year and whose salary, etc. prescribed in Article 28(1) (Employment income) (hereinafter referred to as a “salary, etc.” in this paragraph) to be received within the year is not more than 20,000,000 yen falls under any of the following items, the resident is not required to file a return under the provisions of paragraph (1) of the preceding Article with regard to the income tax related to the amount of taxable gross income and the amount of taxable timber income for the year; provided, however, that this shall not apply in cases specified by Cabinet Order, such as where the resident receives payment of consideration for providing his/her assets, such as real property for the business of the payer of the salary, etc. related to the employment income :

i. where the resident has received payment of a salary, etc. from one payer of salary, etc. and income tax has been withheld or is to be withheld pursuant to the provi-sions of Article 183 (Withholding liability for employment income) or Article 190 (Year-end adjustment) with regard to the whole of the said salary, etc., and if the sum of the amount of interest income, the amount of dividend income, the amount of real property income, the amount of business income, the amount of timber income, the amount of capital gains income, the amount of occasional income, and the amount of miscellaneous income (hereinafter referred to as the “amount of income other than employment income and retirement income” in this paragraph) is not more than 200,000 yen

Tax Agent/Administrator

Under Article 117 of the National Tax Agency Law (Tax Agent/Administrator), individuals who do not have a domicile or residence (excluding offices and business places) in the enforcement area of this law, or corporations without a head office or main office in the enforcement area, must appoint a tax agent to handle submissions of tax returns and other tax-related matters when necessary.

Appointing a tax agent subjects the individual to the regular tax declaration deadlines, not the deadlines applicable at the time of departure.

Tax Agent for Municipal Taxes under Article 300 of the Local Tax Law

Taxpayers of municipal taxes must appoint a tax agent to handle all tax-related matters if they do not have a domicile, residence, office, business place, or dormitory within the municipality. They must report this agent to the mayor or apply for approval to appoint an agent from outside the designated area who is convenient for handling such matters. Changing the tax agent is subject to similar regulations. However, if the taxpayer can prove to the mayor that appointing a tax agent is not necessary for the secure collection of municipal taxes, then appointing one is not required.

Year-End Adjustment at the Time of Departure

Article 190. With regard to a resident who has submitted an employment income earner’s declaration for dependency deduction, etc. and for whom the amount of salary, etc. that is determined to be paid during the year as prescribed in item (i) is not more than 20,000,000 yen, where the payer of salary, etc. via whom the resident has submitted the said declaration makes the last payment of salary, etc. for the year (excluding the case where the resident is expected to submit the said declaration to a payer other than the said payer thereafter by December 31 of the year), if the total amount of income tax set forth in the said item exceeds or falls below the amount of tax set forth in item (ii) as calculated based on the circumstances at the time of the last payment of salary, etc. for the year, the amount of excess must be appropriated to income tax to be withheld upon the last payment of salary, etc. for the year, and the amount of shortfall must be withheld upon the last payment of salary, etc. for the year and paid to the State by the tenth day of the month following the month in which the day of withholding falls:

Notification Related to Affiliation

Foreign nationals working with a work permit must submit a “Notification Related to Affiliation” to the Immigration Bureau upon resigning from their company. The resigned foreign national must fill out the prescribed form with their name, date of birth, gender, nationality, address, residence card number, the name and location of the resigned company, and the resignation date, and submit it to the Immigration Bureau.

Tax in Japan: Fundamentals and Practical Q&As on Stock Options

Taxation of Listed Stocks

Tax Rate:

Net gains from stock sales are taxed at 20.315%.

Tax collection methods:

Through withholding at source, or annual tax return filing.

Securities Account Types:

- Domestic Securities Account: Tax is automatically withheld.

- Foreign Securities Account: Tax must be paid through annual tax return filing.

Special Considerations for Foreign-Issued Stock Options:

When stocks acquired through foreign-issued stock options are held in foreign securities accounts (common scenario), the capital losses cannot be offset against dividend income nor be carried forward to future tax years.

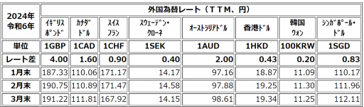

Note: Generally, use the closing rate on the transaction date (or previous day’s rate if unavailable) published by a major Japanese bank.

Tax in Japan: Fundamentals and Practical Q&As on Stock Options

Conversion of Foreign Currency Transactions

Salary Income:

Foreign currency amounts must be converted to Japanese yen using the applicable exchange rate at the time of transaction.

- Income from exercise of stock options or vesting of RSUs:

Use Telegraphic Transfer Middle Rate (TTM) on the date of exercise or vesting Capital losses cannot be combined with dividend income for Japanese tax purposes. - Capital losses cannot be carried forward for Japanese tax purposes.

Capital Gains:

- Income from stock sales:

Use Telegraphic Transfer Buying Rate (TTB) on the date of sale - Cost basis:

Use Telegraphic Transfer Selling Rate (TTS) on the date of exercise or vesting

Note: Generally, use the closing rate on the transaction date (or previous day’s rate if unavailable) published by a major Japanese bank.

Tax in Japan Fundamentals and Practical Q&As on Stock Options

Taxation of Stock Options in Japan: A Comprehensive Overview

In Japan, the taxation of stock options is addressed from three distinct angles: individual income tax, corporate income tax, and compliance with filing and reporting requirements.

Individual Income Tax:

The taxation of stock options hinges on the economic benefit they confer, with crucial considerations being the timing and amount of this benefit. Article 36 of the Japanese Income Tax Act specifies that the taxable income for each type of income, unless stated otherwise, includes the amount earned within that year. This includes non-monetary assets, rights, and other economic benefits, valued at their market equivalent at the time of acquisition.

As a result, nearly all forms of equity-based compensations, including stock options, are taxable. The valuation and timing of these taxes, however, may vary based on the specifics of the compensation.

Corporate Income Tax:

The focus here is on whether stock-based compensation can be deducted for corporate tax purposes. Typically, such compensation is deductible from a corporation’s taxable income if it is recognized as an expense for the individual receiving it for their personal income tax. Nevertheless, there are notable exceptions. For instance, compensations paid to directors are generally not deductible under Japanese tax law, with further nuances depending on whether the compensation is issued by a domestic or foreign entity.

Filing and Reporting Requirements:

Beyond personal tax responsibilities, the Japanese tax system mandates various filing and reporting obligations. Domestic companies must report both the issuance and the exercise of stock options. Likewise, Japanese securities firms are required to report the exercise of listed stock options. Foreign entities must also fulfill reporting obligations in Japan when they issue equity-based compensations to employees within the country.

This blog aims to demystify these intricate tax considerations for professionals navigating the complexities of stock options in Japan, providing a clearer understanding for both tax experts and their clients.