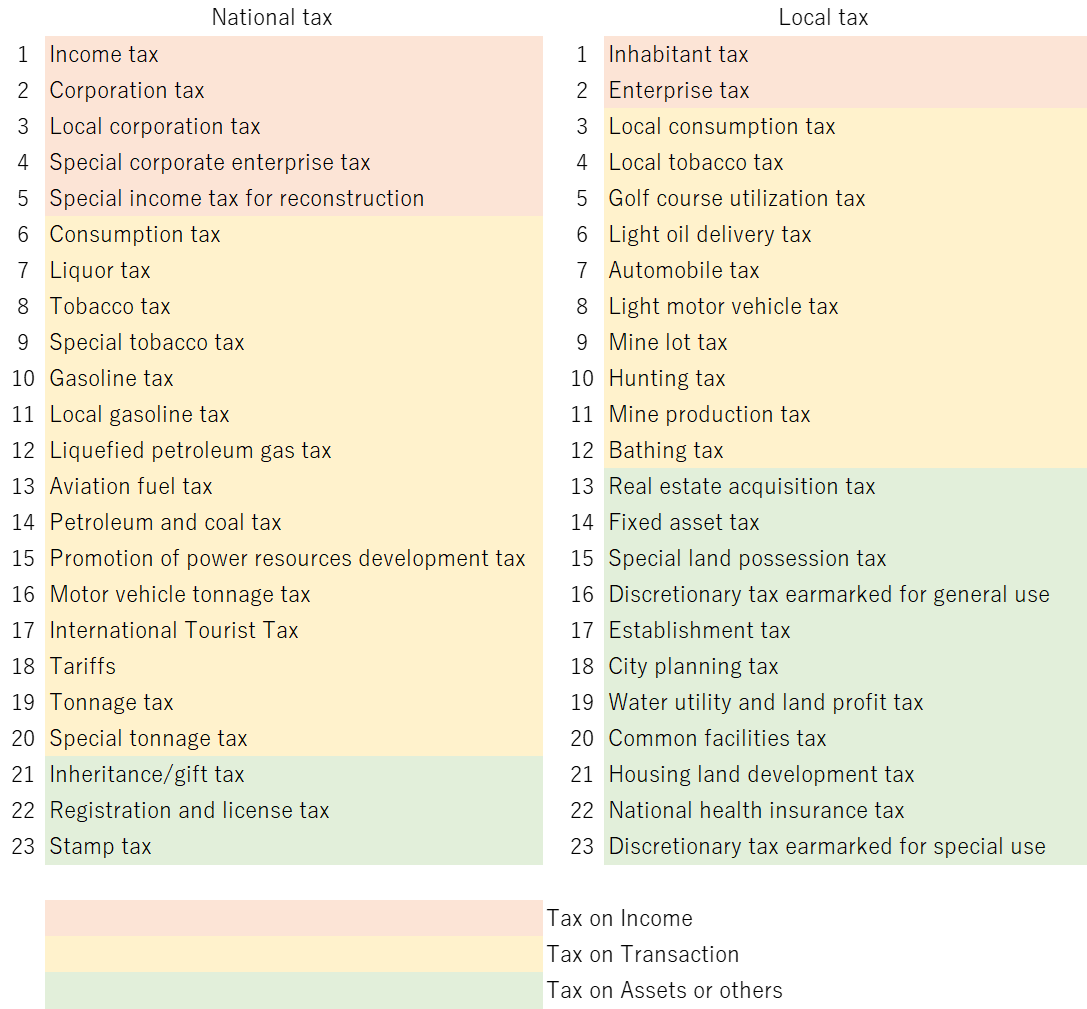

Japan’s tax system, while extensive with over 40 different tax items, primarily revolves around a few key areas for most taxpayers: the income taxes and the consumption tax. The system is evenly divided between national tax and local tax in terms of both the number of tax items and the overall revenue generated. Although there are various special-purpose taxes on specific goods such as liquor, tobacco, and automobiles, these tend to have less impact on the majority of individual taxpayers.

Crucially, Japan’s tax laws apply universally to all individuals, regardless of nationality. However, the tax implications for each taxpayer can vary significantly depending on the specific regulations governing each type of tax. Understanding these nuances is essential for effective tax planning and compliance, particularly for those subject to multiple tax jurisdictions or with complex financial arrangements.

In summary, while Japan’s tax structure may appear intricate at first glance, focusing on the core components, such as income and consumption taxes, simplifies the landscape for most taxpayers. A thorough understanding of the detailed regulations and how they apply to individual circumstances is critical for navigating the system effectively and ensuring compliance.

Japanese Tax Items